|

|

|

|

May 13, 2010

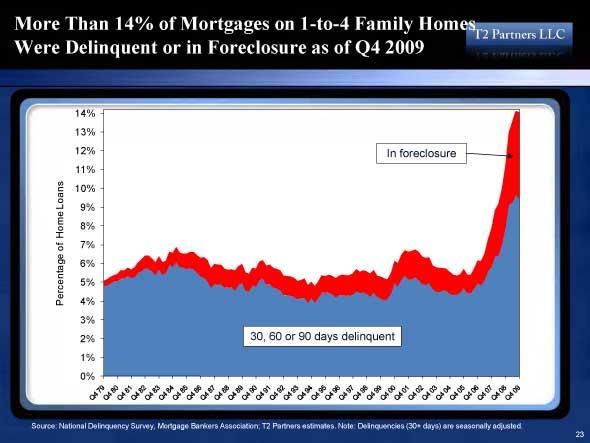

Reality Check

Dr. Housing Bubble is looking at the state of the real estate market. It is not good. Not good at all. Let me start with a quote that explains the above chart. The ultimate sign of housing distress is foreclosure. This should be obvious. So for all the talk of a housing recovery I point to the above chart. Today, as in right now, we are in record territory for the number of homes in foreclosure. 14 percent of all U.S. mortgages are in some form of foreclosure.So are things actually improving? Would the government lie to you? No and yes. ...foreclosure filings are still at record levels. In fact we are heading to a 3.5 to 4 million foreclosure year in 2010! This is somehow a positive thing for the market? People forget that foreclosures happen because of underlying economic issues. If everyone was making big bucks and homes were going up in value then we wouldn't have this problem. Just look at the number of foreclosure filings back in 2005. Roughly 60,000 to 70,000 per month. Last month we hit 367,000+ which was an all time record. When foreclosure filings get back down to more normal levels, then we can say the housing market is improving.If the numbers are still rising then things are not improving. No matter what the government says. So who is making the housing market these days (providing loans)? I'm sure you can guess. But no need for guessing. There are answers. 96.5% of all originated loans are now government backed. Remember Fannie Mae and Freddie Mac and their epic continuing losses?The housing market has been nationalized. As in bought by the government. I suppose it is better than outright theft. That comes later when taxes have to rise to pay for the "fun". Banks are moving on current REOs (the small batch that they have) and pumping this up as good news but the 90 days plus foreclosure number is still trending up. How is this magic done? We've talked about it above. You simply don't move on delinquent homeowners. You ignore actual losses. You mark your assets to fantasy valuations.So that may explain why the economy seems to be trending up. A LOT of home owners are living rent free. Why does that make any sense at all? Two reasons come to mind. One is that if the banks had to acknowledge their losses they would be failing. Which is to say the banking system is kaput. Another reason is that a property with people living in it will be better maintained than one that is vacant. Now about the nationalization of the mortgage industry. The bailouts have been one large transfer of wealth to the banking sector. Remember that the bailouts were brought about under the guise of helping the housing market and keeping people in their homes. None of that has happened. Ironically the only thing that seems to keep people in their home is when they stop paying their mortgage! If that is the strategy we have arrived at after $13 trillion in bailouts and backstops to Wall Street we are in for a world of problems.Yes we are. May I also suggest reading Foreclosures, Auctions, and Banks Obscuring Financial Data by Dr. Bubble. My guess is that Europe is in no better shape. And that does not even take into account the coming collapse of the Chinese real estate bubble. Cross Posted at Power and Control posted by Simon on 05.13.10 at 01:26 AM |

|

May 2010

WORLD-WIDE CALENDAR

Search the Site

E-mail

Classics To Go

Archives

May 2010

April 2010 March 2010 February 2010 January 2010 December 2009 November 2009 October 2009 September 2009 August 2009 July 2009 June 2009 May 2009 April 2009 March 2009 February 2009 January 2009 December 2008 November 2008 October 2008 September 2008 August 2008 July 2008 June 2008 May 2008 April 2008 March 2008 February 2008 January 2008 December 2007 November 2007 October 2007 September 2007 August 2007 July 2007 June 2007 May 2007 April 2007 March 2007 February 2007 January 2007 December 2006 November 2006 October 2006 September 2006 August 2006 July 2006 June 2006 May 2006 April 2006 March 2006 February 2006 January 2006 December 2005 November 2005 October 2005 September 2005 August 2005 July 2005 June 2005 May 2005 April 2005 March 2005 February 2005 January 2005 December 2004 November 2004 October 2004 September 2004 August 2004 July 2004 June 2004 May 2004 April 2004 March 2004 February 2004 January 2004 December 2003 November 2003 October 2003 September 2003 August 2003 July 2003 June 2003 May 2003 May 2002 AB 1634 MBAPBSAAGOP Skepticism See more archives here Old (Blogspot) archives

Recent Entries

• The bullet did it. End of narrative?

• Reality Check • La Raza • Moconology for those who want to moconomize • What is gay? Mind if I ask? • madly not caring • Doing The Conservative Thing • Happy Birthday, Salvador Dalí! • You Can Already Count The Cost • The Andrew Sullivan/American Family Association Identity Politics Alliance Against Privacy!

Links

Site Credits

|

|